By Nigel Clarke, March 6, 2016

The influence of big money on the political process can often make it difficult not to view government as simply middle management in a structure of global corporate oligarchy. The central and overarching goal of the TPP is to make official the existence of this relationship. It is ironic that the acronym for the principal tool in this elimination of national sovereignty, ISDS, is only a semi-circle away from the villain we are told is our greatest threat; ISIS.

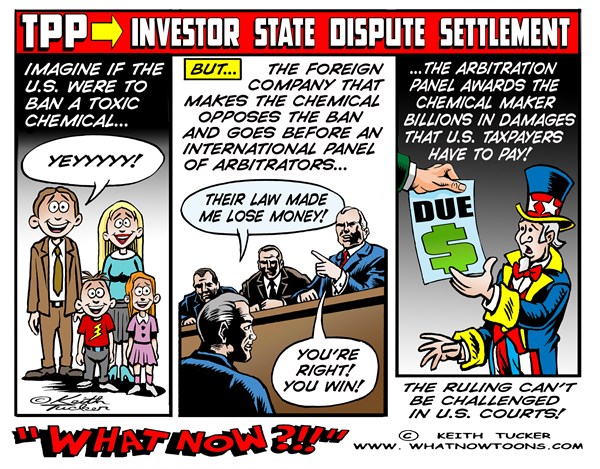

What ISDS would do is set up a special court system in which corporations could sue TPP countries over government policies which they believed would reduce their profits or (perhaps more importantly) expected profits. This would effectively allow global corporations to pick and choose what they would permit governments to do.

It is a court system in which the arbitrators would be corporate lawyers who would, unlike a judge in a country, have no obligation to legislate in the public interest. Additionally, these lawyers would not be bound by usual rules of independence and impartiality. They could act as arbitrators in one case, and as corporate representatives in the next. And the decisions of these corporate lawyers would be both authoritative and secretive; authoritative in that their decisions could not be challenged in the courts of the country being impacted, secretive in that the machinations of the court would be exempt from disclosure under the United States Freedom of Information Act.

While ISDS has existed in previous trade agreements, never before has it been as comprehensive, or with as wide a scope. The TPP would effectively create a new class of global citizen. Regular people could not access the ISDS system, neither could small businesses, human rights organizations, or labor unions. Only large corporations would occupy this pedestal of authority over governments.